The Ultimate Guide To Pvm Accounting

The Ultimate Guide To Pvm Accounting

Blog Article

About Pvm Accounting

Table of ContentsPvm Accounting - QuestionsGet This Report on Pvm AccountingGet This Report on Pvm AccountingPvm Accounting for BeginnersNot known Incorrect Statements About Pvm Accounting Pvm Accounting for Dummies

Supervise and take care of the creation and authorization of all project-related billings to clients to foster excellent interaction and avoid problems. construction bookkeeping. Make sure that appropriate records and documents are submitted to and are updated with the IRS. Make certain that the bookkeeping procedure abides by the law. Apply needed construction bookkeeping requirements and treatments to the recording and coverage of building and construction task.Understand and maintain typical cost codes in the bookkeeping system. Interact with different financing companies (i.e. Title Firm, Escrow Firm) concerning the pay application process and demands needed for repayment. Handle lien waiver disbursement and collection - https://businesslistingplus.com/profile/pvmaccount1ng/. Monitor and fix bank problems including charge abnormalities and inspect differences. Help with carrying out and keeping inner economic controls and treatments.

The above statements are intended to define the basic nature and degree of job being done by people designated to this classification. They are not to be interpreted as an exhaustive checklist of duties, obligations, and abilities needed. Personnel might be needed to perform obligations outside of their normal duties every now and then, as required.

Getting My Pvm Accounting To Work

Accel is looking for a Building Accounting professional for the Chicago Workplace. The Building and construction Accountant executes a range of accounting, insurance compliance, and task administration.

Principal duties include, but are not limited to, managing all accounting features of the firm in a timely and accurate manner and offering records and timetables to the firm's CPA Firm in the preparation of all financial declarations. Guarantees that all accountancy treatments and functions are taken care of properly. In charge of all economic documents, pay-roll, financial and everyday operation of the bookkeeping function.

Functions with Project Supervisors to prepare and publish all monthly invoices. Creates regular monthly Job Price to Date reports and working with PMs to reconcile with Task Supervisors' budgets for each job.

Not known Incorrect Statements About Pvm Accounting

Efficiency in Sage 300 Construction and Realty (previously Sage Timberline Office) and Procore building monitoring software program a plus. https://penzu.com/p/7b3bcf6b053c3fa6. Should additionally excel in various other computer software application systems for the prep work of reports, spreadsheets and various other audit analysis that might be required by administration. Clean-up bookkeeping. Have to possess strong organizational skills and capability to focus on

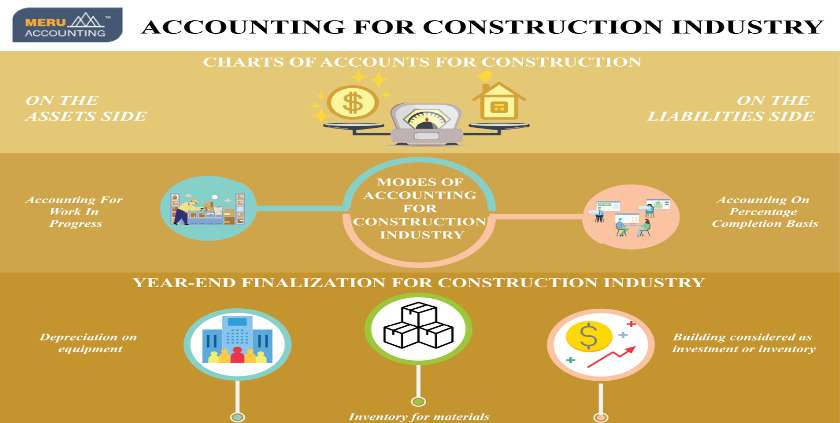

They are the economic custodians who make certain that construction tasks remain on budget plan, adhere to tax obligation laws, and maintain monetary transparency. Building accounting professionals are not simply number crunchers; they are tactical companions in the building procedure. Their main function is to manage the financial aspects of construction projects, guaranteeing that resources are designated effectively and monetary dangers are reduced.

All about Pvm Accounting

They function carefully with project supervisors to produce and monitor budgets, track expenses, and forecast economic needs. By maintaining a limited hold on job finances, accountants help prevent overspending and economic troubles. Budgeting is a keystone of successful construction tasks, and construction accountants contribute hereof. They develop click for info detailed budget plans that encompass all task costs, from products and labor to authorizations and insurance coverage.

Building accountants are well-versed in these policies and make sure that the job abides with all tax obligation requirements. To excel in the role of a building and construction accountant, individuals require a strong instructional foundation in accountancy and financing.

In addition, certifications such as Certified Public Accountant (CPA) or Qualified Construction Sector Financial Specialist (CCIFP) are very pertained to in the sector. Working as an accounting professional in the building and construction sector features a special set of difficulties. Construction projects frequently involve limited target dates, transforming regulations, and unexpected expenditures. Accounting professionals need to adjust promptly to these difficulties to keep the project's economic health and wellness intact.

Excitement About Pvm Accounting

Ans: Building and construction accountants develop and keep an eye on budgets, determining cost-saving possibilities and guaranteeing that the task remains within budget plan. Ans: Yes, construction accounting professionals handle tax obligation conformity for building tasks.

Introduction to Building Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction business need to make hard selections among numerous economic options, like bidding process on one job over another, choosing funding for products or equipment, or setting a job's earnings margin. On top of that, building is an infamously unpredictable industry with a high failure price, slow time to payment, and inconsistent money circulation.

Production includes duplicated procedures with quickly recognizable prices. Production needs various procedures, products, and equipment with varying expenses. Each task takes area in a new location with varying website problems and one-of-a-kind challenges.

The 4-Minute Rule for Pvm Accounting

Durable partnerships with suppliers reduce arrangements and boost performance. Irregular. Regular use various specialized service providers and distributors influences performance and capital. No retainage. Repayment arrives in full or with regular settlements for the complete agreement amount. Retainage. Some portion of payment might be kept up until project conclusion also when the specialist's work is finished.

While conventional suppliers have the benefit of controlled settings and maximized manufacturing processes, construction companies must continuously adjust to each new project. Even rather repeatable jobs need alterations due to site conditions and various other variables.

Report this page